Frustration is rising over Covid drug shortages in China, and there are no easy answers

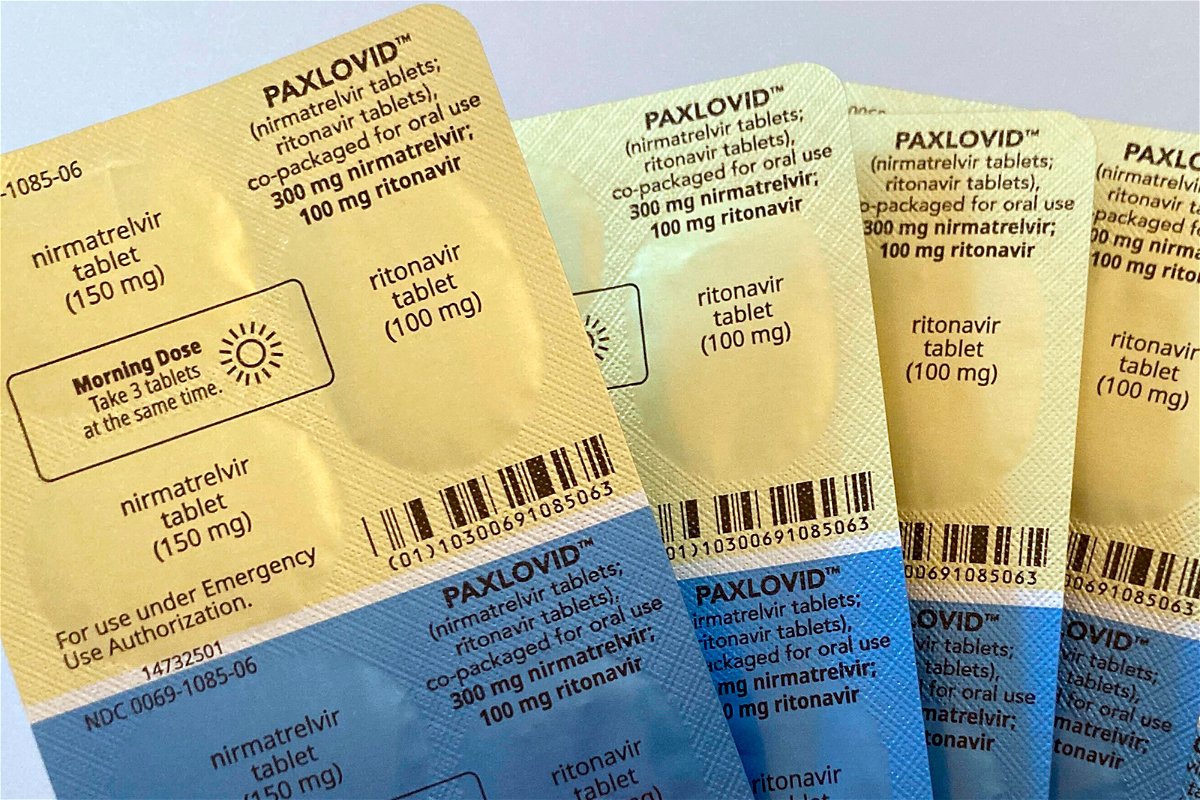

Frustration is rising over Covid-19 drug shortages in China. Doses of the anti-viral drug Paxlovid are displayed here.

By Simone McCarthy, CNN

As Jo Wang, an event planner in Beijing, watched her family members fall ill with Covid-19 one by one late last month she had a single goal: find antiviral pills to protect her elderly grandfather when his turn came.

After three days of trying and failing to purchase a box of Pfizer’s Paxlovid on an e-commerce platform, she got lucky, scoring the Covid treatment via an official channel on the fourth day and receiving it by mail on the sixth. But Wang, who was breaking the rules by seeking the prescription proactively — before her grandfather fell ill — was also wracked with guilt.

“I felt really bad at that time … you don’t know how many days it will take to buy this medicine, it is completely unknown. And you don’t know how long the people in your family can hold on,” she said, stressing her fear that if she waited until the 92-year-old fell ill, it would be too late to get the pills, which are most effective early in the illness. “It’s a very desperate situation.”

Wang is not the only resident scrambling to secure Western medications as a wave of Covid-19 overwhelms China, driving up demand for treatment — especially for the country’s large undervaccinated elderly population.

In recent weeks, many have turned to the black market where hawkers claim to sell Covid treatments ranging from illegal imports of Indian-made generics of Pfizer’s Paxlovid and Merck’s molnupiravir to the bonafide product — up to nearly eight times the market price.

Rising frustration over the shortages was compounded by an announcement Sunday that the government had failed to reach an agreement with Pfizer to include Paxlovid under its national insurance plan, with officials saying the price asked was too high. That decision could mean that after March 31, the drug will only be available to those who can afford to pay full price, with current rates reportedly around 1,900 yuan ($280) per course.

Paxlovid has been shown to reduce the risk of death and hospitalization in high risk patients when used soon after the onset of symptoms. Last February, the drug, widely used in developed countries, became the first oral pill specifically for Covid to be authorized in China.

China did agree to cover two other treatments used for Covid-19 in the latest talks — the traditional Chinese medicine Qingfei Paidu and the homegrown antiviral pill Azvudine. There is limited data on how well Azvudine protects against severe disease.

The pricing pitfall and shortages, nearly a year after the pill was first authorized and months after Pfizer tapped a domestic drugmaker for local production, show the challenges facing China as its government grapples with demand for treatments for its population of 1.4 billion after abruptly dropping its Covid controls last month.

Prized pill

Currently, Pfizer’s imported pill is available in community hospitals in some cities, including Beijing, Shanghai, Tianjin and Guangzhou, according to state media. It is also sold on several e-commerce platforms, where there is some suggestion in local reports that supply constraints are easing.

But there are questions about how broadly the pills will be distributed across China and if there is sufficient medical resources to prescribe them — an urgent issue as the outbreak shifts from urban hubs to smaller cities and rural China. Experts say procurement appears to be decentralized, with the pills more readily available at hospitals in better resourced major cities and tougher to find elsewhere.

On Monday, Pfizer’s CEO Albert Bourla said the company had ramped up exports, sending millions of courses of Paxlovid to China in the past couple weeks, and was working with its domestic partner Zhejiang Huahai to manufacture Chinese-made Paxlovid in the first half of this year, according to Reuters.

But Bourla, speaking at a conference in San Francisco, also quashed hopes the company might reach a deal with China for domestic drugmakers to produce a generic version of the drug to be sold in-country — denying a January 6 Reuters report that such an arrangement was being discussed.

US-based Merck, known as MSD internationally, on Wednesday said on its WeChat account that it would take legal action against some manufacturers that are supplying unauthorized versions of its Covid drug. The company said it would also partner with domestic firm Sinopharm to supply China with its pill, which is sold under the brand name Lagevrio. Neither Western firm currently holds a patent for the drugs in China, according to a WHO-affiliated database, though both have filed for one.

But as the immediate shortages — and issues of cost — play out in one of the world’s largest generic drug-producing countries, they also throw the spotlight on global issues related to intellectual property rights, according to experts who examine access to medicines.

Two Chinese companies slated to manufacture generic versions of Paxlovid have already submitted their products for evaluation by the World Health Organization (WHO), according to the WHO-affiliated Medicines Patent Pool (MPP) — a signal that they are ready to begin producing the medicine.

Those companies, Zhejiang Huahai and Apeloa Pharmaceutical, along with two others in China, were granted sublicenses in 2022 to make the full generic pill to supply 95 lower and middle income markets — not including China — under an earlier deal between Pfizer and the MPP, an organization that facilitates access to treatments for people in poorer countries.

“At the scale of the health crisis taking place (in China), the most logical next step (would be) that these licenses are expanded to include allowing domestic supply in China, including from other producers (in the region),” said Ellen ‘t Hoen, a former executive director of the MPP and current head of the Medicines Law & Policy project.

However, if the drug developer was unwilling to take that step — as Bourla indicated Pfizer was on Monday — there are measures China could take, such as pledging to protect companies that make generic supplies or importing generics from elsewhere, using legal measures allowed under the World Trade Organization rules during health emergencies, ‘t Hoen said.

That potential has been discussed in public forums in China. Commentators there point out the country has no track record of using these flexibilities, which are often employed with caution by countries, given their potential to irk foreign pharmaceutical companies and the countries where they are based.

In China’s case, concerns about impacting the local economy — in which foreign pharmaceutical firms are major employers — was likely a key reason for the government’s reticence to use such measures, said Yanzhong Huang, a senior fellow for global health at the Council on Foreign Relations in New York.

Beijing this month called on authorities to enhance oversight of online sales of drugs and crack down on price gouging, false advertising and the infringement of intellectual property.

Pfizer talks stall over cost

China may be hoping that more domestic antiviral pills in development are able to fill the void. Throughout the pandemic, its regulators have largely opted for homegrown tools to confront the virus — with Beijing yet to approve a foreign Covid vaccine.

Health officials have recently sought to assure the public about affordable access to treatments and downplay the potential impact of the government’s failure to include Paxlovid in its national insurance scheme. A top health official on Wednesday said that hundreds of pills to alleviate Covid symptoms were already covered by insurance and new viral treatments were in the pipeline.

State-run nationalist tabloid Global Times on Monday ran an opinion piece blaming “US capital forces” for China’s inability to cut a deal with Pfizer to include the pills in the national insurance.

“During the past days, a growing number of US politicians and media outlets have been making shrill ‘warnings’ about the epidemic in China … If they do care about it, why don’t Pfizer drop some pursuit of the profit, and cooperate with China with a little more sincerity?” said the article.

Bourla on Monday said talks broke off after China had asked for a lower price than Pfizer is charging for most lower middle income countries.

In a separate statement to CNN, Pfizer declined to comment on what price it had offered, but said: the company “will continue to collaborate with the Chinese government and all relevant stakeholders to secure an adequate supply of Paxlovid in China” and remained “committed to fulfilling the Covid-19 treatment needs of Chinese patients.”

But for those who have been grappling with the immediate problems of gaining access to medicines for themselves and their families, like Wang in Beijing, there is a feeling — for now anyway — that the system isn’t working.

“It’s cruel … no matter how we feel, there’s nothing we can do,” she said. “It’s not the case that your effort or expectation can make the situation better.”

The-CNN-Wire

™ & © 2023 Cable News Network, Inc., a Warner Bros. Discovery Company. All rights reserved.

CNN’s Cheng Cheng contributed reporting.