Negative equity surges: Millions of Americans now underwater on auto loans

Canva

Negative equity surges: Millions of Americans now underwater on auto loans

A woman sits at the wheel of her car looking stressed.

Early signs of a negative equity surge in the auto loans sector have begun to emerge in the first quarter of 2023. According to data from Edmunds, the average negative equity value of auto trade-ins was $5,341 in Q4 2022, up 29% from the previous year. The number of vehicle sales that involved a trade-in with negative equity also jumped by 17% over the same period.

These trends are two of several that are spurring concerns within the automotive and finance industries. A sudden, dramatic increase in negative equity could put countless borrowers in dire financial circumstances and have a ripple effect throughout the financial industry. Automoblog examined the impact of the recent negative equity surge across the automotive industry.

![]()

Automoblog

What is negative equity?

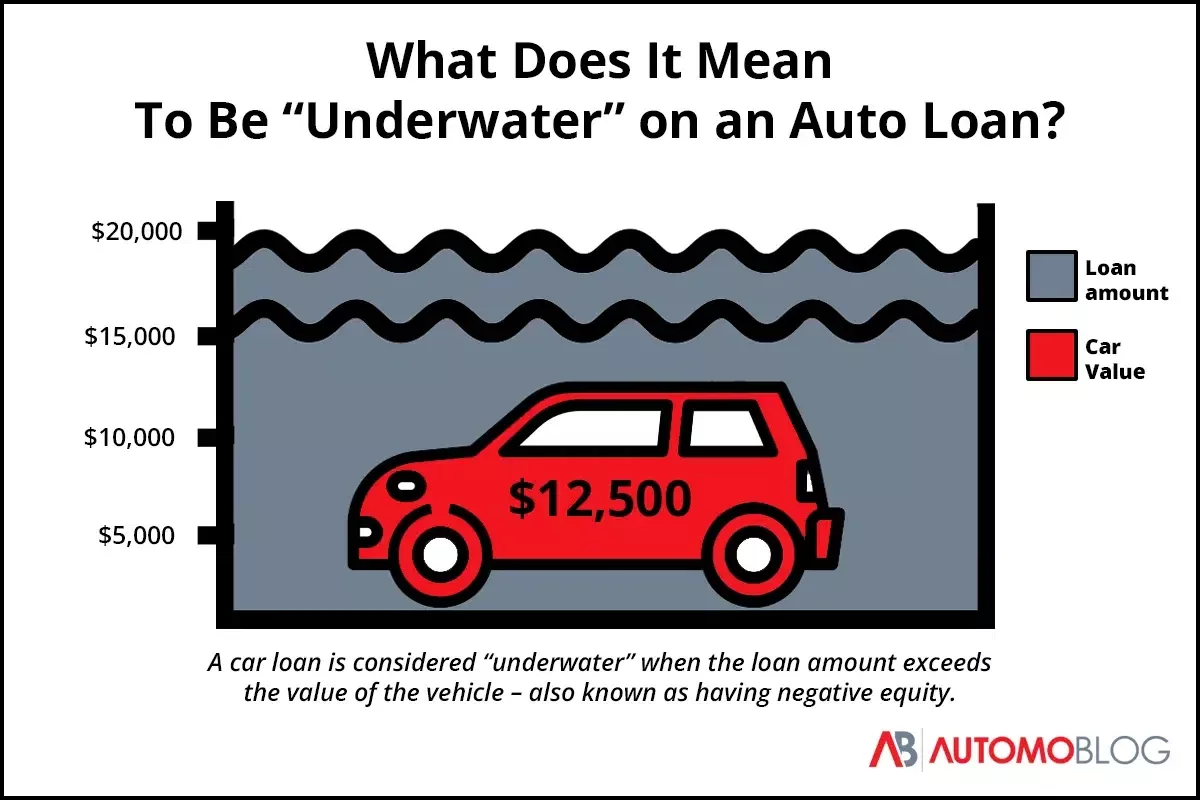

Graphic visualization of red car underwater to demonstrate negative equity on auto loans.

Negative equity is when the amount owed on a vehicle exceeds the value of the vehicle. For example, if a person owes $20,000 on a car that is worth $12,500, the vehicle has $7,500 in negative equity. Also known as being “underwater” on a loan, holding negative equity is a risky financial position for a borrower to be in. It can also lower a person’s credit score.

Why people are suddenly underwater on auto loans

It hasn’t been just one thing that’s put American borrowers in this situation. A “perfect storm” of factors has gathered at one time to create a difficult situation for the automotive finance industry.

Automoblog

Supply chain issues

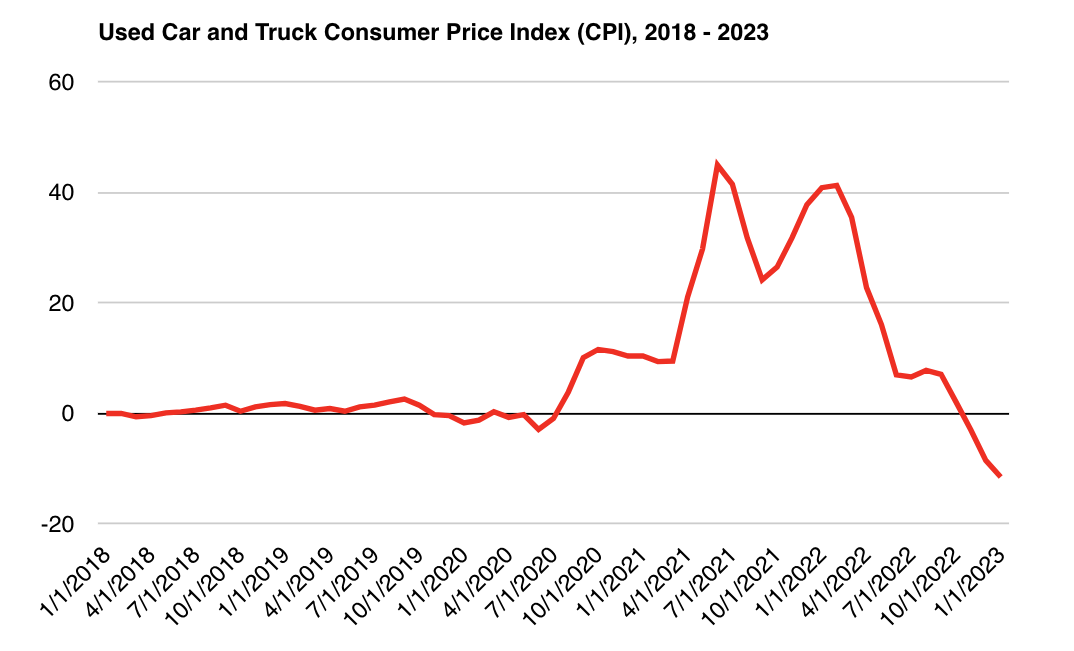

Line chart with red line showing used car and truck Consumer Price Index from 2018-2023.

The chip shortage of the last several years and other supply chain issues have had a dramatic and well-documented impact on the supply of new vehicles. A resulting lack of availability and increased prices also drove up the price of used cars to record highs in 2021 and 2022.

This meant that people who bought used cars during this time did so at inflated prices.

Dropping used car prices

But drastically inflated prices on pre-owned vehicles is only one part of the equation. When prices were at their highest, many people found their cars were suddenly worth much more than before, often carrying positive equity. This means that, while buyers had to pay more for used cars, used car owners could also sell them for more, too.

However, used car prices started to fall rapidly towards the end of 2022. As a result, the value of many of the cars purchased over the previous two years dropped significantly. For many borrowers, that value dipped below the amount they owed over a period of just a few months.

Automoblog

High interest rates

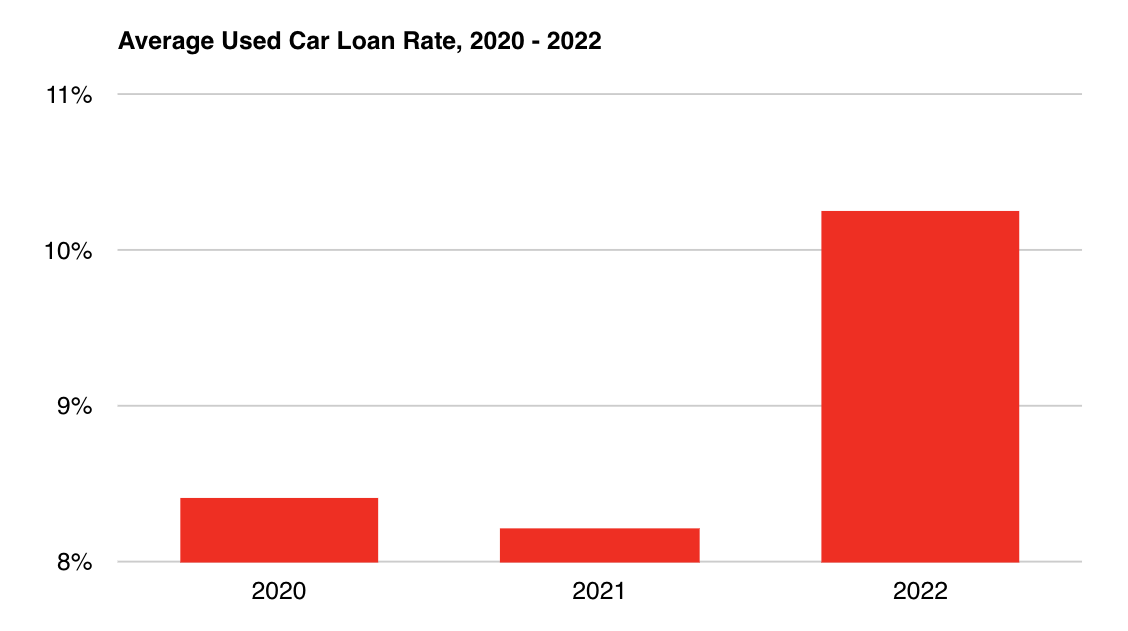

Red bar chart showing average used car loan rates from 2020-2022.

The inflated price of used cars added enough expense on its own, but car buyers were also hit with a dramatic increase in annual percentage rates (APRs) at the same time. As the Federal Reserve attempted to tackle inflation in 2022, it ordered a series of increases to the federal funds rate. The result was the federal funds rate jumping from 0.33% to 4.75% between March 2022 and 2023.

Lenders then increased the auto loan rates they offered car buyers in turn. According to the Experian State of Automotive Finance Report for Q4, 2022, the average auto loan rate for used cars increased by nearly 25% from 8.22% in 2021 to 10.26% the following year.

Due to the increases, used car buyers started paying more in interest costs on top of already record-high car prices. Together, these factors contributed to an affordability crisis in the auto industry that is still a source of concern in 2023.

Rising cost of living

In some circumstances, borrowers may have been able to weather the storm by paying more towards the principal of their auto loan. However, a roughly 6.5% rate of inflation during 2022 meant that borrowers also had to spend more on utilities, food, and other life expenses. This left many without the ability to counteract a drop in the value of their car with additional payments.

Canva

Loan delinquencies are also on the rise in 2023

A loan officer reviews the terms of a customers contract.

Recent reports would suggest that many may have been left without the ability to even meet their expenses – let alone find extra room in the budget to pay more towards their car loans.

According to a report from Cox Automotive, auto loan delinquency rates have climbed to their highest levels in over 15 years.

Auto loans are considered to be “severely delinquent” when past due by 60 days or more. The data from Cox Automotive shows that 1.89% of all auto loans were severely delinquent in January, 2023 and at the highest rate since 2006, the first year included in the data series.

However, the trend is even more pronounced among borrowers with lower credit scores. The research found that among subprime auto loans, 7.3% were severely delinquent. This rate represents a more than 7% increase over the previous year and is also the highest rate since at least 2006.

While not increasing at quite the same pace as delinquencies, defaults are also on the rise. The auto loan default rate reached 2.72% in January, up 6.2% from December and 33.5% from the prior year. However, January’s rate is still below the annual average rate of 2.9% from 2019.

Canva

Lenders are taking notice of the negative equity surge

Am older couple looks concerned as they review their finances at home.

Holding a vehicle loan with negative equity is an issue for individual borrowers, but it can also pose problems for lenders when it happens en masse. Automoblog spoke with Andy Arledge, Associate Executive Vice President, North Carolina State Employees’ Credit Union (SECU) Consumer Lending, to learn what he and others at his credit union are seeing in the auto loans sector.

“Since vehicles are depreciating assets, most borrowers have likely had to deal with negative equity at some point when financing a vehicle in the past,” says Arledge. “However, borrowers who made little to no down payment, financed for longer loan terms, or paid over the Manufacturer Suggested Retail Price [MSRP] for a new vehicle over the past few years may now have higher amounts of negative equity than what they’ve experienced previously.”

He adds, “If those same borrowers are now looking to trade in the collateral for a different vehicle, they are either having to make larger down payments or roll the negative equity into the new loan.”

Auto loan credit availability is shrinking

Over the past several months, credit for auto loans has started to become less available – perhaps in response to the increase in negative equity. The Dealertrack Auto Credit Index (DACI) tracks fluctuations in auto credit availability on a monthly basis. It uses factors such as down payment amounts, loan approval rates, negative equity rates, subprime loan share, term lengths, and yield spreads to determine overall availability of auto loan financing.

In January, the DACI fell to 98, a decline of 1% from the previous month and 3.9% on the year. This reflects a decrease in lending confidence as it signals lenders becoming more careful about who they grant auto loans to and the amounts and terms they offer.

Canva

What can borrowers who are suddenly underwater do?

A woman closely studies her laptop.

Most of the factors that caused the negative equity surge are far out of most people’s control. However, borrowers who find themselves suddenly underwater on their auto loans do have a few options to try and improve their situation.

“Borrowers have a couple of options to consider in this case,” says Arledge. “The first option is to pay extra each month to pay the loan down quicker and reduce the amount of negative equity.”

Eric Ridley, an attorney specializing in financial planning at Ridley Law Offices, agrees that this should be most borrowers’ first approach.

“Your best bet, hands down, is to make some extra payments on the loan whenever possible,” says Ridley. “This will help reduce the balance and eventually get you to a point where you owe less than the car is worth. Even just an extra hundred dollars every month or two can add up rapidly. You don’t need to make those payments with your regular vehicle payment; just send the lender an extra $25 or $50 on payday and you’ll see results quickly.”

Canva

Other options for underwater auto loans

A loan officer discusses financing with a soldier.

However, many cash-strapped borrowers may not be able to afford even a modest extra payment in their current situation. For these borrowers, a refinance auto loan may be another way of dealing with negative equity.

“Another option is to consider a refinance to reduce the interest rate and/or reduce the term of the loan,” Arledge says. “While we have seen an increase in vehicle interest rates over the past year, this still may be a viable option for some borrowers as long as the collateral meets the lender’s lending guidelines.”

Ridley also says that refinancing could be a smart move for some borrowers, despite current interest rates.

“Refinancing could lower your interest rate and make it easier to pay down the balance,” he says. “You’ll still have negative equity, but a lower rate might make it possible to pay extra and get the loan under control.”

Both parties say that trading in a car that’s currently underwater on its financing is an option, but one that people should exercise caution in executing.

“Borrowers could also consider trading in or selling the vehicle,” says Arledge. “But due to the negative equity, they may have to bring money to the table in order to pay off the existing loan.”

Ridley also says that, for many borrowers, choosing to keep a vehicle with negative equity may be a superior option to trading it in.

“With lots of negative equity, you may need to hold the vehicle longer than you planned – until the loan is fully paid off – and repair rather than trade it in,” he says. “This will let you move onto your next vehicle without trailing negative equity into another loan.”

Borrowers who find themselves holding onto negative equity can consider following the advice of financial professionals like Arledge and Ridley. The Consumer Financial Protection Bureau (CFPB) also has a few resources online to help understand and manage negative equity.

Will the negative equity surge continue?

The negative equity trend could very well continue beyond Q1 in 2023. Used car prices continue to drop as people put more miles on their vehicles. The Federal Reserve has announced more rate hikes for this year, meaning consumer auto loan rates will likely increase as well. And while some within the auto and semiconductor industries are optimistic about the potential improvement of supply chain issues this year, automakers are still cutting vehicles from their production cycles.

All of this means, unfortunately, that a difficult situation for borrowers may get even more difficult before it gets better.

This story originally appeared on Automoblog and has been independently reviewed to meet journalistic standards.